As we kick off 2026, the Greater Toronto Area real estate market is showing some very clear trends: more inventory, slower sales activity, modest price adjustments, and a market that increasingly rewards preparation and strategy.

In this January 2026 Market Update, we’ll break down what’s happening across Toronto, Durham, and York Regions, how interest rates factor into today’s conditions, and what this means if you’re thinking of buying, selling, or simply staying informed.

Big Picture: More Listings, Fewer Sales

According to the Toronto Regional Real Estate Board (TRREB), there were 3,082 home sales reported across the GTA in January 2026, representing a 19.3% decline compared to January 2025. During the same period, 10,774 new listings were added to the MLS® System, down 13.3% year-over-year, but still elevated relative to recent months.

On a seasonally adjusted basis, January 2026 home sales declined month-over-month compared to December 2025, while new listings increased slightly. Both the MLS® Home Price Index (HPI) Composite benchmark and the average selling price trended lower month-over-month, confirming a softer start to the year driven by affordability constraints and cautious buyer sentiment.

Across all regions, January saw a significant increase in new listings compared to December, while home sales declined month-over-month. This has resulted in:

- More choice for buyers

- Longer days on market

- Increased pressure on sellers to price and market correctly

This is not a market driven by panic or hype—it’s a market driven by value, patience, and negotiation.

If you’re wondering whether this environment makes sense for buyers, we explore that in detail here

Toronto Region – January 2026

Key Stats (All Property Types):

- New Listings: 4,077 (+109% from December)

- Home Sales: 1,074 (-21.2%)

- Average Price: $948,698 (-3.84%)

- Days on Market: 45 (+9.76%)

Toronto continues to show strong supply growth, while sales activity remains muted. This imbalance has created opportunities for buyers, particularly in the condo and townhouse segments.

Average Prices by Property Type:

- Detached: $1,541,791 (+2.92%)

- Semi-Detached: $1,146,188 (+2.13%)

- Townhouse: $1,086,583 (-11.44%)

- Condo: $631,932 (-4.72%)

What stands out here is the resilience of detached and semi-detached homes, while townhomes and condos continue to adjust.

For a look at how the market evolved leading into this year, you can revisit our previous update

Durham Region – January 2026

Key Stats (All Property Types):

- New Listings: 1,084 (+105%)

- Home Sales: 412 (-9.45%)

- Average Price: $818,694 (-3.05%)

- Days on Market: 39 (+2.63%)

Durham continues to attract long-term buyers looking for value relative to Toronto, but pricing remains sensitive—especially for townhomes and condos.

Average Prices by Property Type:

- Detached: $925,397 (-1%)

- Semi-Detached: $692,125 (-5.78%)

- Townhouse: $712,521 (-4.96%)

- Condo: $455,810 (-4.13%)

This environment favours buyers who are prepared and sellers who invest in strong presentation and marketing.

If you’re selling locally, especially in Pickering, this guide is worth reading

York Region – January 2026

Key Stats (All Property Types):

- New Listings: 1,996 (+103.5%)

- Home Sales: 554 (-18.9%)

- Average Price: $1,110,582 (-7.76%)

- Days on Market: 47 (+11.9%)

York Region experienced one of the larger price adjustments month-over-month, particularly for detached homes.

Average Prices by Property Type:

- Detached: $1,401,393 (-10.3%)

- Semi-Detached: $996,264 (+2.79%)

- Townhouse: $1,045,920 (-3.55%)

- Condo: $561,628 (-6.29%)

Homes that are priced accurately and marketed strategically are still selling—others are sitting.

Knowledge is power

Interest Rates: What to Watch in 2026

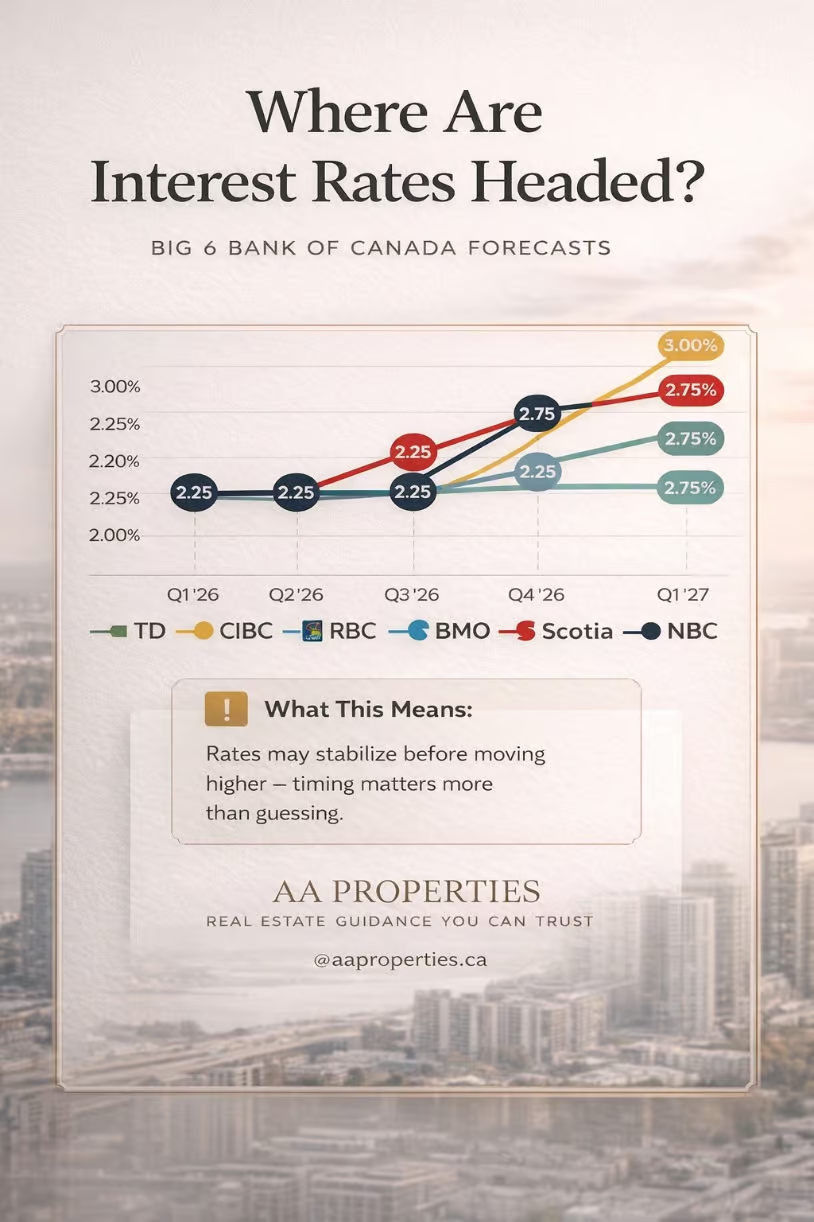

The Bank of Canada began 2026 by holding its policy interest rate at 2.25%, providing a period of stability after several years of volatility. While borrowing costs remain well below their 2023 peak, affordability continues to influence buyer behaviour.

From a pricing perspective, TRREB reported the MLS® HPI Composite benchmark was down approximately 8% year-over-year in January 2026, while the average GTA selling price declined 6.5% year-over-year to $973,289. These adjustments reflect the combined impact of borrowing costs and slower sales activity.

Looking ahead, future rate decisions will depend on inflation and broader economic conditions. The Bank of Canada has several scheduled announcement dates throughout 2026, including March, April, June, July, September, October, and December. While forecasts from Canada’s major banks vary, the general expectation is for relative stability in the near term, with the possibility of upward pressure later in the year.

For buyers and sellers alike, this reinforces the importance of making decisions based on current market data and strategy—not speculation.

What This Means If You’re Buying

- You have more inventory to choose from

- Negotiating power has improved

- Conditional offers are making a comeback

However, the best opportunities go to buyers who are informed and decisive. Understanding neighbourhood-level pricing is critical.

Helpful tool

What This Means If You’re Selling

An important shift we are beginning to see in early 2026 is renewed competition for well-presented, well-priced homes. In several GTA neighbourhoods, A-style properties—homes that show exceptionally well, are staged properly, and are priced in line with current market value—are starting to attract strong interest and, in some cases, multiple offers.

This trend is closely tied to interest rate stability. With the Bank of Canada holding the policy rate steady and forecasts from Canada’s six largest banks suggesting potential upward pressure on rates in the second half of 2026 (Q3–Q4), some buyers are becoming more decisive. Rather than waiting, they are acting now to secure a home before borrowing costs potentially rise.

It’s important to note that this does not apply to all listings. Homes that are overpriced or poorly prepared are still taking longer to sell. The difference in today’s market is strategy—presentation, pricing, and marketing matter more than ever.

Today’s market rewards sellers who:

- Price realistically

- Prepare their home properly

- Invest in professional marketing

If your goal is to sell successfully in 2026, strategy matters more than ever.

Final Thoughts

January 2026 confirms what many expected: this is a balanced, thoughtful market—not a race. Whether you’re buying, selling, or simply watching from the sidelines, having the right information makes all the difference.

At AA Properties, our focus is always on guiding our clients with clarity, transparency, and strategy.

If you’d like to learn more about who we are and how we work

Let’s move forward with confidence.

All market data provided by TRREB.

Stay Up-To-Date With AA Properties

You’re more than a client to us, you’re a valued part of our inner circle. To get the most recent market news, see our latest listing, and get our newest blogs in your inbox each month, sign up to our newsletter.